Buying a resale property — whether it’s a flat, an independent house, or a villa — can be a smart move.

You avoid construction delays, get what you see, and often find homes in established neighborhoods.

But there’s a catch.

Unlike new launches by reputed developers, resale properties require far more legal due diligence.

You’re not just buying a home — you’re buying its legal and financial history.

So how do you protect yourself?

Here’s a complete legal checklist for buying a resale flat or house in India, based on years of real-world property law practice.

🧾 1. Verify the Title of the Property

This is non-negotiable.

You must confirm that the seller is the legal owner of the property and has the right to sell it.

✅ Ask for:

- Sale deed (registered)

- Khata/Patta/RTC (depending on the state)

- Mutation records

- Latest property tax receipts

- Encumbrance Certificate (EC) for the last 30 years

💡 Hire a property lawyer to conduct a detailed title verification — don’t rely on the seller’s word.

🏦 2. Check for Any Home Loans or Outstanding Mortgages

If the seller has taken a home loan, the property may be mortgaged to the bank.

You need:

- A Loan closure letter

- No Dues Certificate (NDC) from the bank

- Release deed from the Registrar’s office

- Bank NOC (No Objection Certificate)

🛑 Never proceed without checking if the loan has been cleared.

🧾 3. Request the Latest Encumbrance Certificate (EC)

An EC is proof that the property has no legal dues or charges registered against it.

✅ Apply for a 13–30 year EC from the sub-registrar office.

Make sure it includes:

- All past transactions

- Mortgages, if any

- Sale/purchase chain

If there’s any gap in ownership or unexplained transaction, investigate thoroughly.

🏛️ 4. Confirm Property Tax Paid Status

Unpaid taxes are a liability that passes on to the buyer.

✅ Ask for:

- Latest property tax receipts

- Online tax records from BBMP, MCD, GHMC, or local body

If taxes are pending, insist the seller clears them before sale.

🏠 5. Check Building Approvals and Layout Sanction

In case of a flat or apartment:

- Ask for the building plan sanctioned by the local authority

- Make sure the flat is part of an approved layout or apartment complex

- Check for completion certificate (CC) and occupancy certificate (OC)

💡 Buying a resale flat without OC can cause legal problems later — especially for Khata transfer, loans, and resale.

📜 6. Confirm Society Membership and Dues (for Flats)

If you’re buying a flat in a gated society or apartment:

✅ Ask the seller or association for:

- Society NOC

- Share certificate (if it’s a cooperative housing society)

- Dues clearance letter

- Any pending maintenance charges or legal disputes

🛑 You won’t be able to register the property if society objections exist.

🏗️ 7. Measure the Actual Area

You’re buying a specific area — don’t just go by the sale deed.

✅ Get a physical measurement of:

- Carpet area

- Built-up area

- Super built-up area

- Plot dimensions (if independent house or villa)

Use a licensed surveyor or architect to verify the floor plan.

🏛️ 8. Confirm Land Use and Zoning (for Plots/Houses)

For independent houses or plots:

- Check if the land is residential (not commercial/agricultural)

- Get Zoning clearance from the town planning authority

- Make sure there’s no land acquisition notification

This is especially important in peri-urban areas and villages.

📑 9. Get the Khata Transfer Procedure Right

In Karnataka, you must ensure the Khata is transferred to your name after purchase.

Steps:

- Seller should submit Form I & II with sale deed

- Pay Khata transfer fee

- Get Updated Khata Certificate & Extract in your name

💡 Without Khata, you can’t pay taxes, get building permits, or sell later.

👨⚖️ 10. Draft a Legally Sound Sale Agreement

The Agreement to Sell should include:

- Details of buyer/seller

- Sale consideration and payment breakup

- Possession date

- Encumbrance clause

- Seller warranties

- Indemnity for past dues

- Penalty clause for default

🖋️ Have this agreement drafted or vetted by a property lawyer.

🏘️ 11. Register the Sale Deed with the Sub-Registrar

On the final day of transaction:

- Execute the Sale Deed

- Pay stamp duty + registration charges

- Register the deed at the local Sub-Registrar Office

Also collect:

- Registered deed copy

- E-Stamp certificate

- Thumb impressions and photos

💡 Registration is what gives you legal title. A notarized or signed paper is not enough.

📂 12. Post-Sale Formalities Checklist

Once registered, you must:

- Apply for Khata transfer

- Update electricity, water, gas connections

- Inform the housing society

- Get mutation done with the revenue department

- Update property insurance (if applicable)

Don’t skip these — they help secure your title.

⚖️ Legal Tip: Always Hire a Property Lawyer for Verification

A resale flat or house comes with:

- Prior ownership history

- Possibility of pending dues

- Potential illegal alterations

- Risks of fraud or forgery

Hiring a real estate lawyer is not optional — it’s a necessity.

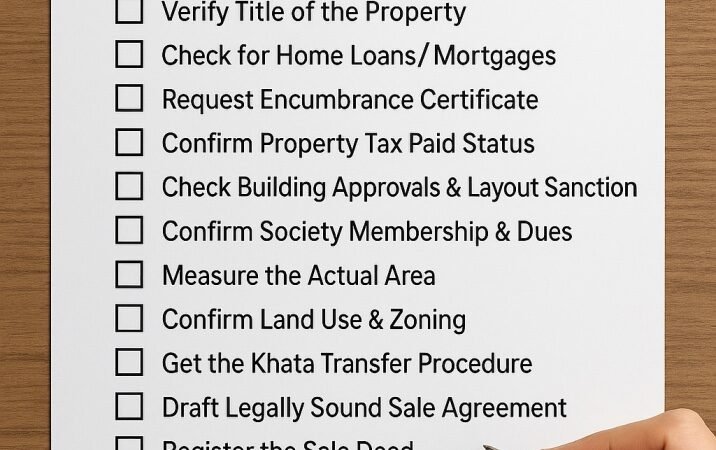

📋 Summary: Resale Property Due Diligence Checklist

Here’s your quick recap:

🔲 Seller’s title documents

🔲 EC (13–30 years)

🔲 Sale deed & Khata/Patta

🔲 Property tax paid proof

🔲 Bank NOC and loan closure

🔲 Society NOC and dues cleared

🔲 Area measurement & plan approval

🔲 OC, CC, Zoning check

🔲 Sale agreement with legal vetting

🔲 Registration of deed

🔲 Post-sale legal formalities

📩 Call to Action

At RJ Property Law, we specialize in:

- ✅ Resale property legal checks

- ✅ Title verification and document scrutiny

- ✅ Drafting legally airtight sale agreements

- ✅ Representation during registration and mutation

Don’t let your dream home turn into a legal headache.

Let us handle your due diligence with precision and care.

📧 Email: ranjinijayaram@rjpropertylaw.com

📞 Phone: +91 80884 17193

🌐 Website: www.rjpropertylaw.com