Latest posts

-

What Tax Benefits Can I Get on Home Loan Interest and Principal in India?

\ Buying a home in India comes with a huge financial commitment. But here’s the good news: 👉 The Indian Income Tax Act offers several deductions on home loan interest and principal repayments — which can significantly reduce your tax burden each year. Whether you’re a first-time buyer or an experienced investor, understanding these tax…

-

How to Improve Your Home Loan Eligibility or Borrowing Limit in India

If you’re planning to buy a home in India and apply for a home loan, one question often arises: 👉 “How do I increase my chances of getting a higher loan amount?” Whether you’re a salaried employee, self-employed professional, or an NRI buyer, improving your home loan eligibility is the key to unlocking better loan…

-

Fixed vs. Floating Interest Rate – Which Is Better for a Home Loan in India?

When applying for a home loan, one of the biggest decisions you’ll face is: Should you choose a fixed or a floating interest rate? This decision can impact not only your monthly EMIs but also your overall cost of borrowing. Let’s break it down step-by-step — legally, practically, and professionally — so that you can…

-

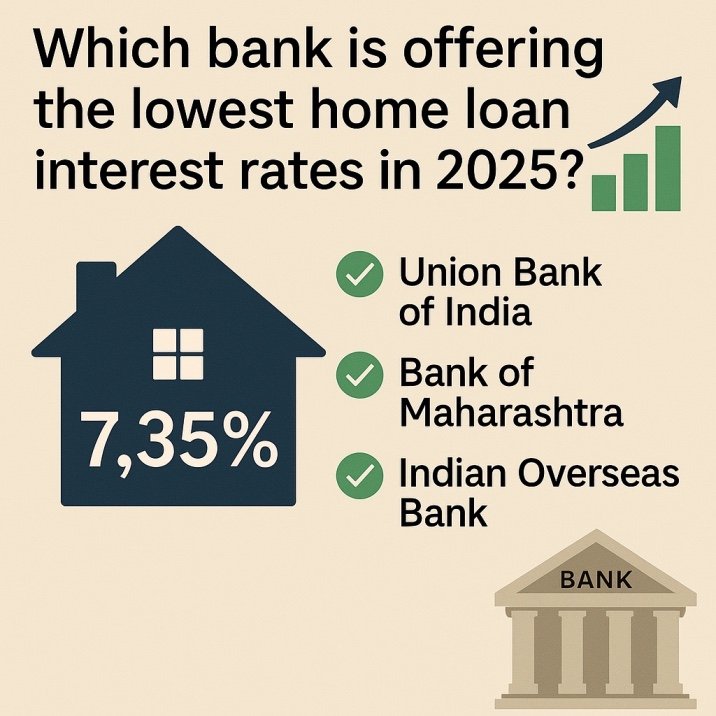

What Are the Eligibility Criteria for a Home Loan in India?

If you’re planning to buy a house in India, chances are you’ll need a home loan to fund the purchase. But before you walk into a bank or click “Apply Now” online, it’s important to know whether you’re even eligible. Banks and housing finance companies in India use strict parameters to assess your loan eligibility.…

-

What Are the Costs Involved in Selling Property in India? (Brokerage, Registration Fees & More)

Selling your property? Before you celebrate the incoming funds, it’s crucial to understand the various costs involved in selling a property in India. Many first-time sellers overlook these costs, only to be surprised later during the registration or income tax filing stage. Let’s break it down. 📜 1. Capital Gains Tax (Long-Term or Short-Term) One…

-

Steps to Sell an Inherited Property or Ancestral House in India (Legal Process Explained)

Selling an inherited property or ancestral house in India isn’t as straightforward as selling a self-purchased one. There are legal formalities, family rights, and tax implications to deal with — and skipping any of these steps can land you in serious trouble. This guide will walk you through the complete legal process, in a way…

-

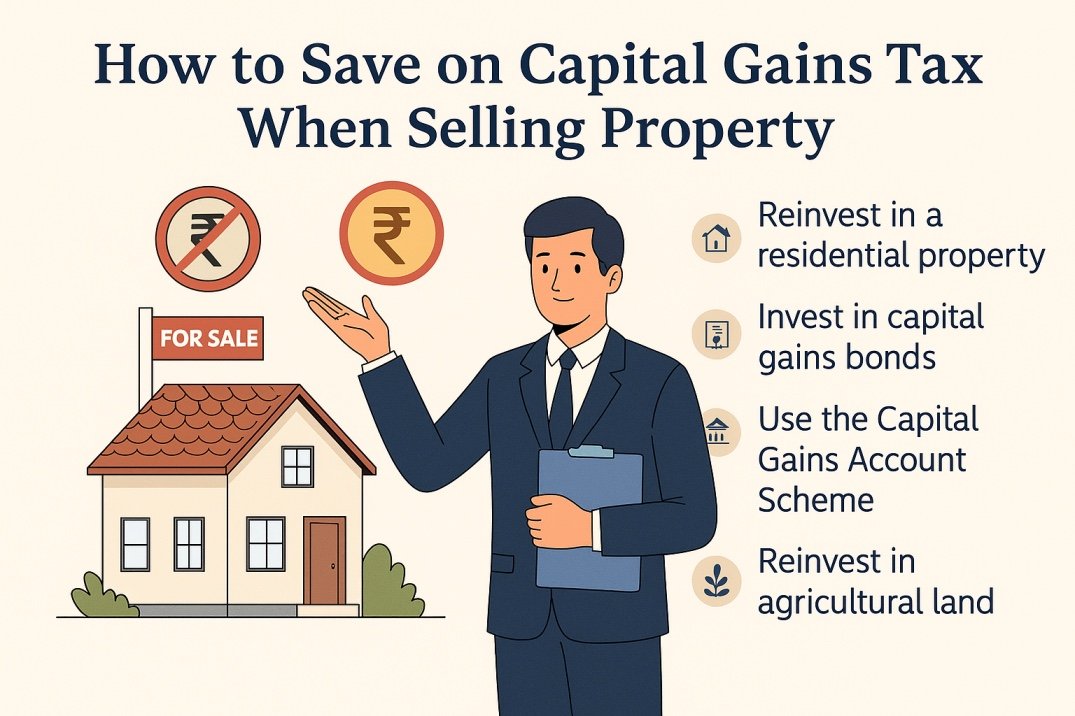

How to Save on or Avoid Capital Gains Tax Legally When Selling Property in India

Selling your property? Great! But once the deal is done, there’s one more thing you can’t ignore: 💸 Capital Gains Tax — the tax you pay on the profit from your sale. Now here’s the good news: 👉 There are legal ways to reduce or completely avoid paying capital gains tax — if you plan…