Latest posts

-

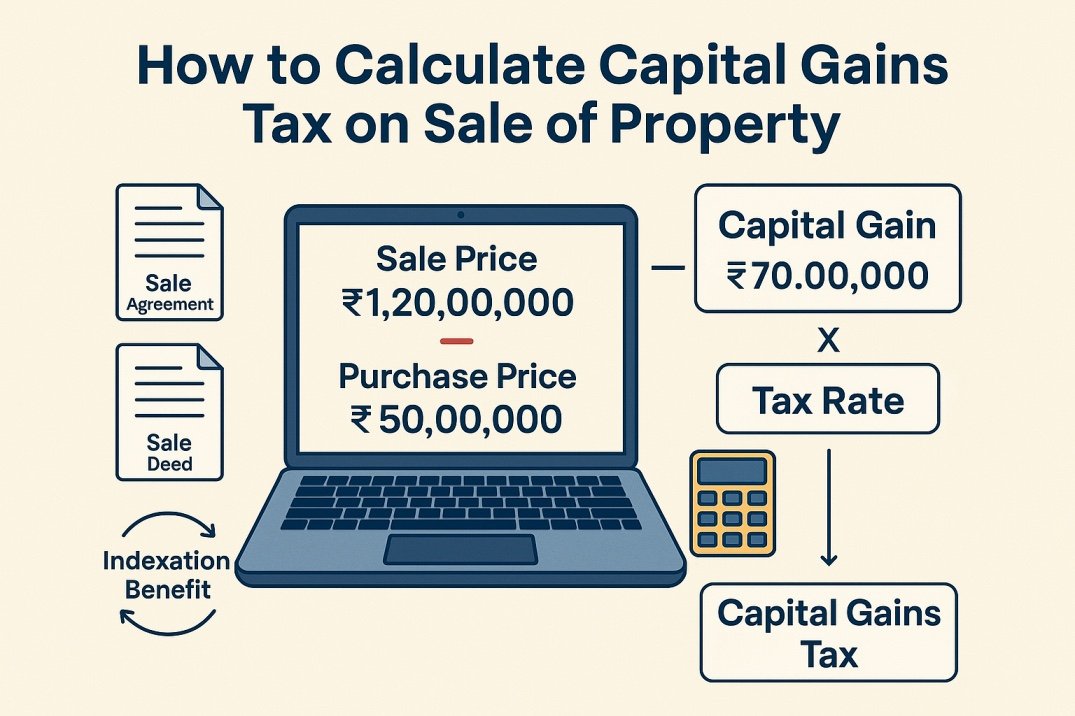

How to Calculate Capital Gains Tax on the Sale of a Property in India

Selling your property? Congratulations — but hold on! Before you celebrate the profit, make sure you understand one important thing: Capital Gains Tax. In India, any profit made from selling a property is considered a capital gain, and it’s taxable under the Income Tax Act. So how do you calculate this tax? How much do…

-

How to Determine the Market Value or Fair Price of My Property in India?

Thinking of selling your property or just curious about its actual worth? Whether you’re a first-time seller, an NRI, or an investor—knowing the true market value of your property is the first step to making an informed decision. But here’s the truth: 📌 The price you feel your property deserves isn’t always what the market…

-

What Documents Are Required to Sell a Property in India? (Legal Checklist for Sellers)

Thinking of selling your property in India? Whether it’s a flat, an independent house, a villa, or a plot — selling real estate isn’t just about quoting a price and finding a buyer. There’s paperwork involved, and missing even one document can delay or derail the entire transaction. So let’s get into it: Here’s the…

-

How to Sell a Property Without a Broker in India (For Sale by Owner Tips)

Selling your property in India without a broker? Yes, it’s absolutely doable — and increasingly popular. More owners today are saying “Why should I pay brokerage when I can do it myself?” But selling a home isn’t just about finding a buyer. There are legal, financial, and procedural steps that must be handled carefully. This…

-

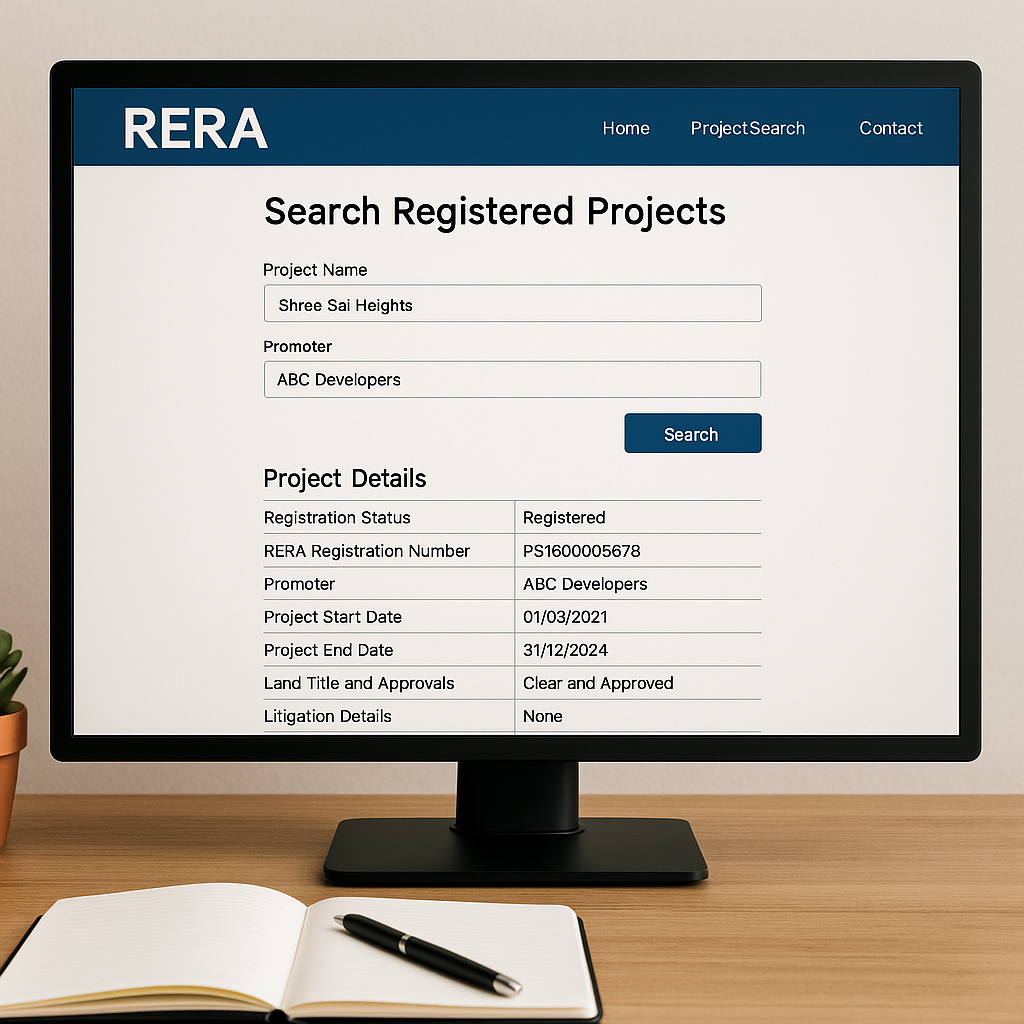

How to Check If a Real Estate Project Is RERA-Registered in India?

If you’re planning to buy an under-construction property in India, one of the first and most important steps is to check whether the project is registered under RERA — the Real Estate (Regulation and Development) Act, 2016. Why? Because RERA registration is what separates legally compliant builders from the ones who cut corners. Let’s walk…